Career Connections

Financial analysts help individuals and organizations make informed investment decisions, manage financial risks, and understand market trends. Whether working on Wall Street or at a local startup, financial analysts use data to guide critical business choices. This in-demand career offers excellent salary potential, diverse industry applications, and multiple education paths—from bachelor’s degrees to advanced certifications like the CFA.

In this article, you’ll learn what a financial analyst does, what degrees and skills are needed, and how to get started in this high-growth profession.

Explore More Articles

AI Boom: Industries on the Rise vs. Industries in Decline

Degrees That Will Thrive in the AI Business Era

What Is a Marketing Manager? Education Paths, Skills, and Career Growth

What Is a Financial Analyst? Degrees, Skills, and Career Outlook

How to Get into Data Analytics as a Career

Explore Degree Subjects

Financial analysts interpret financial data to help businesses make investment, budgeting, and strategic decisions. They study historical performance, evaluate market trends, create financial models, and prepare reports that influence major business moves.

Financial analysts are needed across many sectors—not just banks.

Financial analysts are needed across many sectors—not just banks.

A bachelor’s degree is typically the minimum requirement to become a financial analyst, but certifications and graduate degrees can significantly boost your career prospects.

Most entry-level financial analysts hold a bachelor’s in:

Highly respected in investment roles, the CFA credential requires:

Being a financial analyst goes beyond crunching numbers. The role requires a blend of technical, analytical, and soft skills to interpret data and communicate insights effectively.

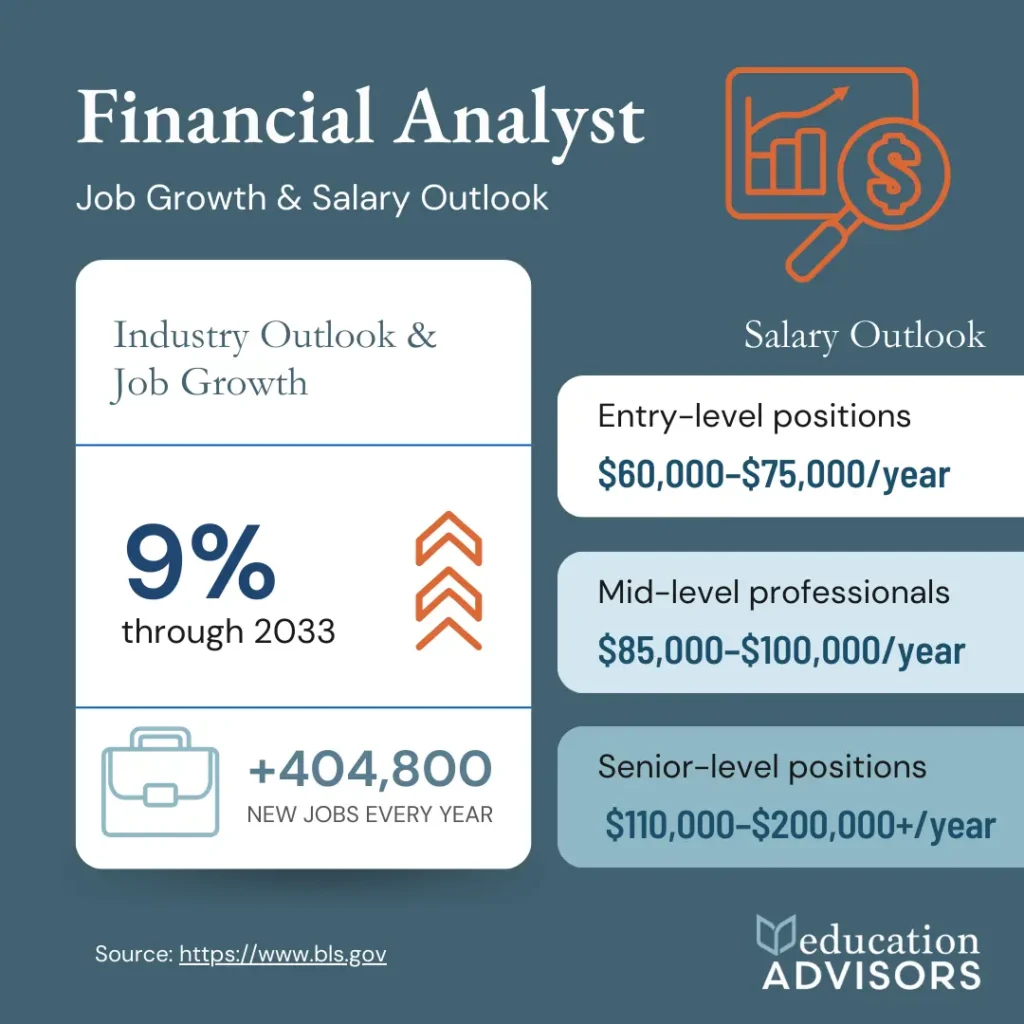

The career outlook for financial analysts remains strong, driven by increasing data availability, global financial complexity, and market volatility.

According to the Bureau of Labor Statistics, employment for financial analysts is projected to grow 8% from 2022 to 2032, faster than the average for all occupations.

Even if you’re new to finance, there are clear steps you can take to break into this field.

You don’t have to wait until graduation to start building financial analyst skills. Online platforms offer affordable, flexible learning.

A career as a financial analyst is both intellectually rewarding and financially lucrative. With roles available across multiple industries—from tech to healthcare to Wall Street—this career path offers variety, stability, and strong growth potential. Whether you’re just starting or planning a career switch, all you need is the right combination of education, technical skills, and curiosity about the financial world.

💡 Ready to launch your financial analyst career? Explore flexible online degrees, certifications like the CFA, or jumpstart with Excel and data analysis courses today!